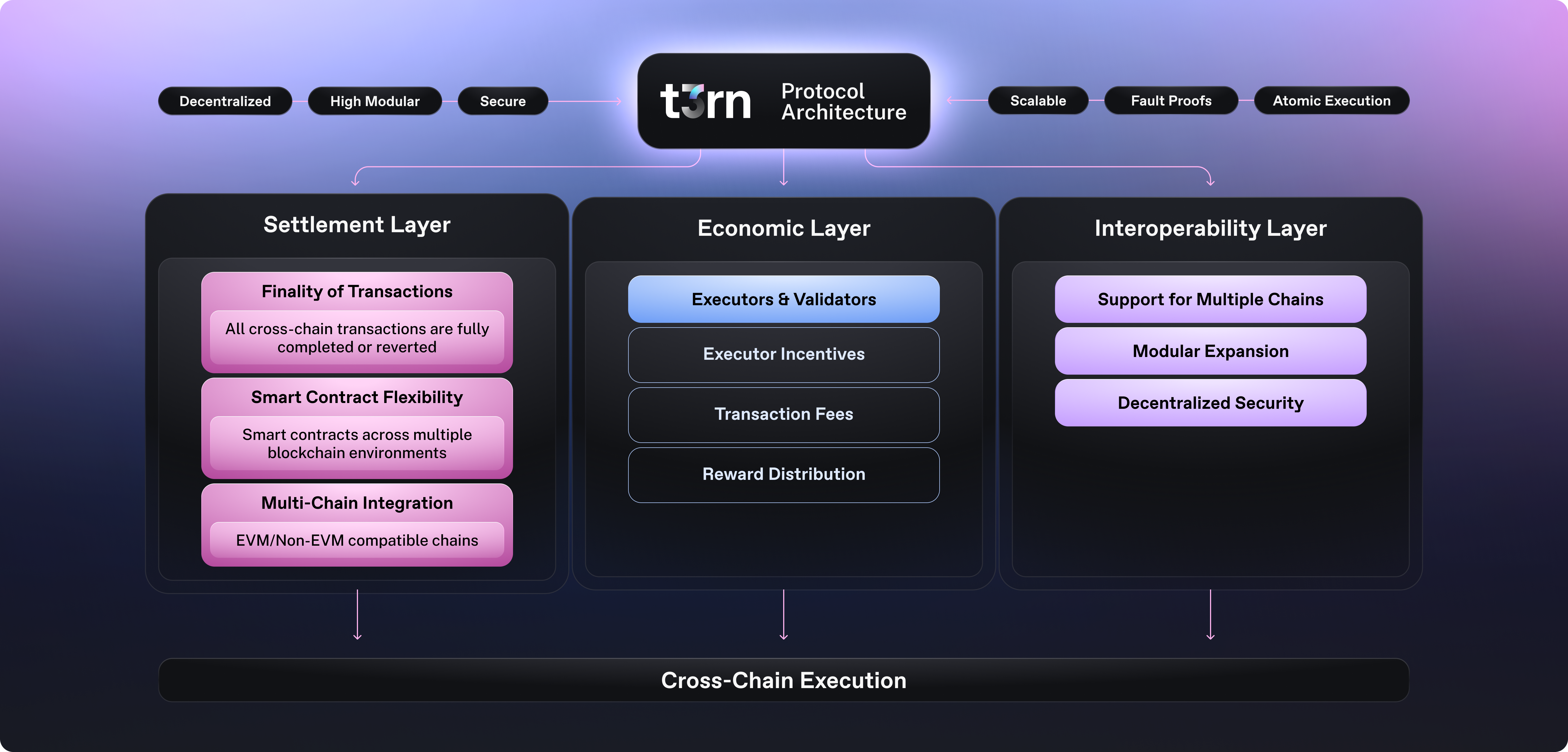

Protocol Architecture

t3rn is the Universal Execution Protocol. A decentralized system built to coordinate smart contract logic across blockchains. Instead of just moving tokens or passing messages, t3rn enables contracts to execute across multiple networks as a single, unified process. No more partial states, manual bridging, or siloed applications.

The ambition of achieving truly interoperable blockchains has always been about more than just bridging assets, it’s about bridging logic: coordinating smart contracts, capital, and computation across ecosystems without complexity, delay, or risk. This is the technology that t3rn has been building, laying the groundwork for a Universal Execution Protocol. A Universal Execution Protocol enables smart contracts on one blockchain to synchronously call, interact with, and trigger contracts on other chains, with atomic finality and no need for wrapping, waiting, or rewriting logic.

Universal Executions

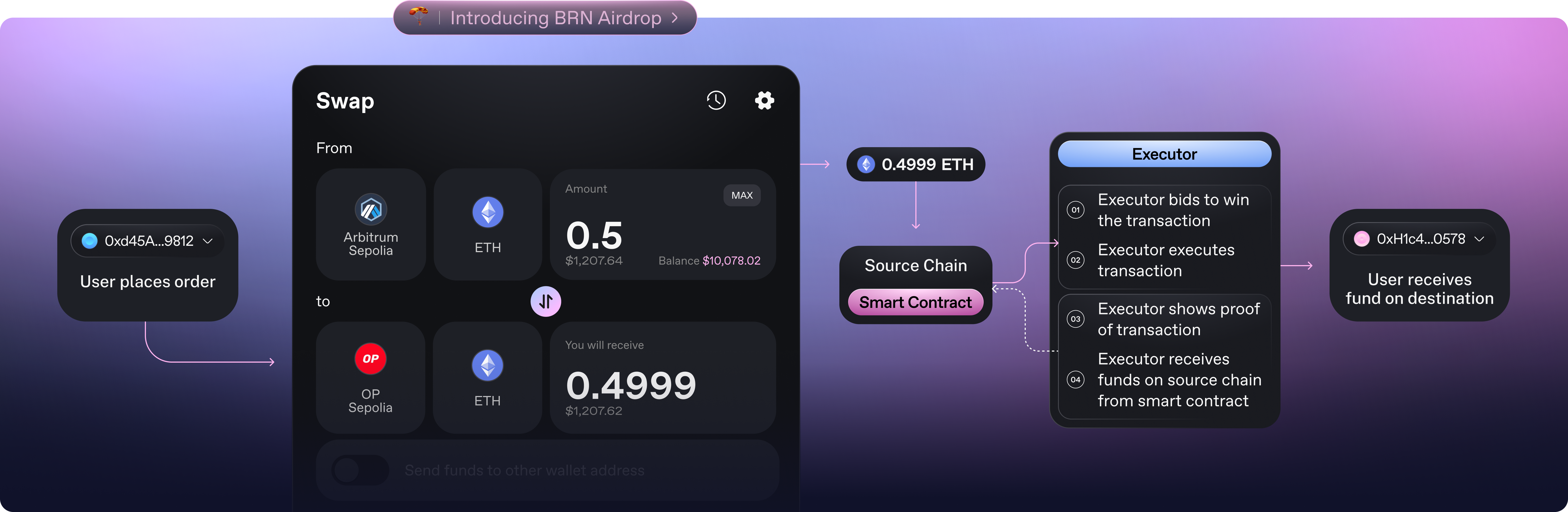

At the heart of the t3rn protocol lies Executors (solvers), key participants in the t3rn ecosystem, are rewarded for successfully completing crosschain transactions. They bid to execute user requests, and the most cost-effective bid is chosen, ensuring competitive transaction fees.

t3rn enables native execution powered by a decentralized network of Executors, instead of relying on lock-and-mint or wrapped token frameworks that carry trust assumptions and limit utility to basic transfers.

How Does It Work:

- Watch & Compete: Executors monitor the network for new intents, for example "Swap 1 ETH on Base for USDC on Optimism", and compete to fulfil them. The bidding process determines who can execute the order most efficiently for the user.

- Execute & Front Capital: The selected Executor performs the action directly on the destination chain, sending USDC to the user, using their own funds up front. This enables fast, trustless fulfillment without requiring user claims or extra steps.

- Verify & Settle: Once complete, the Executor submits proof to t3rn’s settlement mechanism to unlock reimbursement and rewards.

- Cross‑Contract Hooks: If the intent includes downstream function calls (e.g., stake USDC in a yield vault), settlement coordinates those calls atomically, ensuring every step succeeds or the entire bundle reverts.

The Settlement Mechanism

The magic behind t3rn's ability to execute complex crosschain operations reliably lies in its Settlement mechanism. This acts as the coordination engine and source of truth for every multi-step transaction that runs through the protocol. Its purpose is to solve one of the challenges to interoperability: how do you safely complete operations that span multiple chains without leaving behind partial states or vulnerable funds? Whether it’s a three-way swap or a contract call followed by a transfer, t3rn ensures that everything either goes through as intended, or doesn’t go through at all.

Here’s how it works in practice:

- Intent Registration: When a user submits a crosschain action (an "intent"), it’s recorded on the t3rn chain. This registration outlines what needs to happen, where, and in what order.

- Executor Fulfillment & Proof: Executors step in, carry out the requested actions across the destination chains, and submit cryptographic proofs of their work back to t3rn.

- Validation: The protocol checks that each required step has been successfully completed.

- Outcome Handling:

- If everything checks out: A cryptographic hash proof is generated, indicating the operation as complete. Funds and rewards and all the other intended outcomes are settled on the target chain.

- If anything fails: The process is rolled back. No partial outcomes, no stranded assets, just a clean reset to the original state.

This design is what allows t3rn to go beyond simple messaging or bridging. It's built for composability across chains, where developers and users can rely on outcomes, delegating the orchestration of the crosschain settlements to t3rn protocol.

Introducing Intelligent Execution

The shift toward universal execution extends far beyond finance. As composable execution becomes the standard, traditional applications and centralized intermediaries will fade. Smart contracts will operate without front-ends or hosted applications, allowing users, autonomous agents, and protocols to interact with them directly.

The next challenge isn’t just how transactions happen - it’s how well they’re managed. With crosschain volume scaling and network conditions constantly shifting, efficient liquidity routing and smart capital allocation become defining. That’s where the next phase of t3rn begins: AIxecutors.

t3rn has developed a new class of autonomous Executors powered by AI. These agents go beyond basic task fulfillment: they adapt in real time, learn from network activity, and make execution decisions dynamically. As liquidity spans across dozens or even hundreds of networks, AIxecutors will bring the intelligence needed to optimize performance across them all.

They’ll be able to:

- React to live market data to route transactions with better pricing and lower latency.

- Adapt execution strategies based on fees, slippage, or changing conditions.

- Rebalance capital across networks to maintain optimal liquidity exposure.

- Handle operational edge cases, like RPC disruptions or high congestion, without human intervention.

The result is an execution engine that gets smarter over time, learning, adapting, and maximizing outcomes for users. Think of it as an autopilot for crosschain liquidity, backed by cryptographic guarantees.

t3rn enables AI-native agent coordination networks, where autonomous agents analyze onchain state, propose actions, and execute complex transactions across chains based on goals or market conditions. An example includes an AI agent maximizing stablecoin yield by deploying on Curve (Ethereum), borrowing on Venus (BNB), routing via t3rn, and restaking on EigenLayer, all in real time with atomicity, rollback, and verifiable attestations.

Crosschain Execution

One of the standout features of t3rn is its Crosschain Orders, which utilize intent-based execution to process transactions. This system ensures atomic execution, meaning that transactions either fully complete across all chains or fail entirely—eliminating the risk of partial executions.

The Executors play a vital role in ensuring the success of these transactions. They compete through a bidding process to execute user orders, ensuring cost-efficiency and fairness. Executors are also responsible for maintaining liquidity and ensuring that transactions are processed swiftly and accurately.